Bonita Wang Ze-jin, the founder of iDonate, an online platform seeking to raise the transparency of charities by putting their audited reports online, appreciates the need for greater transparency and public monitoring of the work of charities. But she also agrees a charity commission would have too much power, could override the Inland Revenue and interfere with charities’ work.

Wang suggests that one way to enhance transparency would be to emulate the Internal Revenue Service of the United States and use a standard form which charities would have to complete annually. This would mean every charity would have to disclose the same amount and same categories of information. The form would be available for public inspection and it would be easier for members of the public to understand the work of various charities and to compare them.

In July 2012, the Hong Kong Economic Times carried a report about a charity that hired “volunteers” to raise money in a flag-selling event. Investigations showed 70 per cent of the money raised was used in administration. Publishing audited reports could help the public to choose to donate to charities that use funds efficiently.

But for smaller-scale organisations, producing an audited report can be a challenge. Douglas Shum Hong-yuen, the chief executive of Light of Raphael’s Clinic, a small-scale charity providing Chinese medicine services, says completing an audited financial statement is costly and difficult. With auditors charging from several thousand dollars upwards, Shum says he can only rely on asking his friend to help instead of hiring one.

“There will be lots of extra work. For a small charity like us, should we hire another clerk especially for paper work? Yet we do not have enough money,” Shum says.

Mabel Au Mei-po, the director of Amnesty International Hong Kong, understands Shum’s difficulties. She questions whether this requirement should be imposed on all charities. “Some of them [small-scale organisations] may have an annual budget of tens of thousands. How can they afford an audit report?” asks Au. “Actually, the government has the responsibility to stregthen these small-scale charities so that they can meet the requirements of charity regulations.”

She thinks the regulations should take an organisation’s size and resources into account, and worries that setting the bar too high will discourage the development of small NGOs.

“I don’t see why charities need to be regulated,” Au says of the debate surrounding the charity law. Au treasures the diversity of issues that NGOs and charities in Hong Kong speak up on and worries that regulation will stifle their voices. But she does see the necessity of monitoring fundraising activities. She says charities need to tell the public how much they raise and how the money will be used.

But before the public can learn about how donations are used by reviewing the audited statements, they may first want to know if the fundraising is legal. According to the Social Welfare Department, there were 63 complaints about fundraising activities in 2013. In order to monitor these activities,the consultation paper suggested establishing a central register for charities.

But Amnesty’s Mabel Au believes registration might not be the only appropriate way to deal with illegal fundraising. She says that if an organisation claims it is a charity when it is not and holds fundraising activities, it has violated the law and the matter should be handled by police.

However, most charity workers agree something should be done to streamline and rationalise the system for approving fundraising events such as flag-selling days. Wong Chi-yuen, a community organiser at the Society for Community Organisation says the procedures to apply for permission to hold fundraising activities are very complicated and involve multiple government agencies.

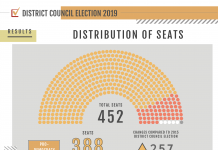

The Social Welfare Department examines and approves flag selling and fundraising applications, while the Food and Environmental Hygiene Department is responsible for checking on charity bazaars. The Television and Entertainment Licensing Authority is in charge of charity lotteries and the Lands Department handles the use of public areas.

Wong says an organisation may have to apply to each individual body for its permission to hold a single event. He further explains that each department may then assign different time slots for the event. This means a charity would have to apply for more days in order to secure a time slot where approvals from all relevant departments overlap. This means that time slots that are marked as taken by the organisation are not actually going to be used, but other organisations are prevented from booking them. “This is a lose-lose situation. It wastes everyone’s time,” says Wong.

Despite suffering from red tape, Wong also disagrees with the setting up of a new charity commission to oversee such activities. He believes the present system can be reformed.

It does seem the Law Reform Commission has taken some of the concerns of the NGO community into account in its final recommendations issued in December last year. The report recommends that all tax-exempt charities and those who solicit donations from the public should be registered with a government department, and that its financial statements should be made available to the public. However, it now proposes that only charities with an annual income exceeding HK$500,000 will have to file audited reports to the register. Those that are registered as companies will still have to do so with the Companies Registrar, however.

The decision to withdraw the proposal for setting up a powerful charities commission and the addition of the advancement of human rights to the list of charitable purposes may have gone some way towards addressing civil society concerns.

After six years of heated debate, Bernard Chan Chi-sze, former chairperson of the Law Reform Commission’s Charities Sub-committee, says:“Our ultimate goal is to let citizens be more confident on charitable organisations. We hope we do not see more mistrust or scepticism.” But as the cases of the Forthright Caucus and the Hong Kong Women Workers’ Association show, the question of what causes count as charitable and how much control there should be over charities is far from definitively settled.