Hedge fund manager Edward Chin Chi-kin, convener of the group, 2047 Hong Kong Finance Monitor, is also worried about threats to the rule of law. He points to remarks made by Zhang Xiaoming, director of the Central Government’s Liaison Office and a Mainland legal scholar in September that said the Chief Executive was in a “special legal position that transcends the three branches” of the executive, the legislature and the judiciary.

“It’s getting very scary,” says Chin, who adds such comments raise questions about the separation of powers in Hong Kong and whether it can maintain its free markets.

So far, such worries have failed to slow the growth of Hong Kong’s economic ties to the Mainland. From the Mainland and Hong Kong Closer Economic Partnership Arrangement (CEPA) in 2003, to the launch last year of the Shanghai-Hong Kong Stock Connect, which allows buyers from both places to buy stocks from the two markets in a much more convenient way, Hong Kong and the Mainland have been expanding areas of cooperation since the handover in 1997.

According to statistics from the Census and Statistics Department, the Mainland has been a major player, either as the largest or second largest foreign investor, in Hong Kong since 2000.

Some worry that this may breed a culture of complacency and overdependence on the Mainland, hurting Hong Kong’s international character and long-term prospects. In August, Martin Murphy, the former head of the Economic-Political Section at the US Consulate in Hong Kong, criticised Hong Kong for “having grown fat and lazy on Mainland tourism and entrepôt services” and added: “The economy is just one arena in which Hong Kong would benefit from less ‘Mainlandisation’.”

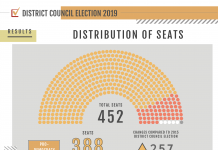

Investment banker Vincent Chan has researched the linkage between the Hong Kong and Mainland stock markets and discovered they share similar trends. This indicates movements on the Hong Kong stock exchange are highly connected to the performance of the Mainland stock market and economy.

One of the most obvious cases is the striking similarity in movements on the Shanghai Composite, Hang Seng and H-share indices between November 2014 and early October this year. When the People’s Bank of China cut its interest rate to 5.6 per cent last November, all bourses rose. Another similarity could be seen in June this year, when the Hang Seng Index experienced a dramatic drop after a Chinese stock market crash.

Vincent Chan notes Chinese companies are the major component of Hong Kong’s stock market. He says 60 per cent of the capitalisation of the Hang Seng Index is made up of Mainland stocks. As for the rest, more than 20 per cent are stocks in overseas companies, while local businesses make up less than 20 per cent.

Chan explains Hong Kong is considered to be different from other cities in the Mainland because it is well known for having a free market where investors can easily practise risk control. Buyers can conveniently withdraw from their investment whenever they want. However, Chinese authorities may intervene heavily in the market like they did in the August crash, which may indirectly affect the stability of Hong Kong’s stock market. The unstable investment environment makes it difficult for foreign investors to execute risk-control plans.